Some Known Questions About How Does a Cash Out Refinance Work? - Moreira Team.

The Greatest Guide To Get a Cash Out Refinance Loan - Freedom Mortgage

The cash-out refinance process is similar to the process you go through when you buy a house. After you understand you meet the requirements, you choose a lending institution, submit an application and paperwork to underwriting, get an approval and wait on your check. Let's take a closer look at each of these actions: 1.

Some of the most common cash-out refinancing requirements include: A Credit rating Of At Least 620 To refinance, you'll usually need a credit report of a minimum of 580. Nevertheless, if you're wanting to take squander, your credit rating generally will need to be 620 or higher. A Debt-To-Income Ratio (DTI) Of Less Than 50% Your DTI ratio is the amount of your monthly debts and payments divided by your overall monthly earnings.

How How Does a Cash Out Refinance Work? - Moreira Team can Save You Time, Stress, and Money.

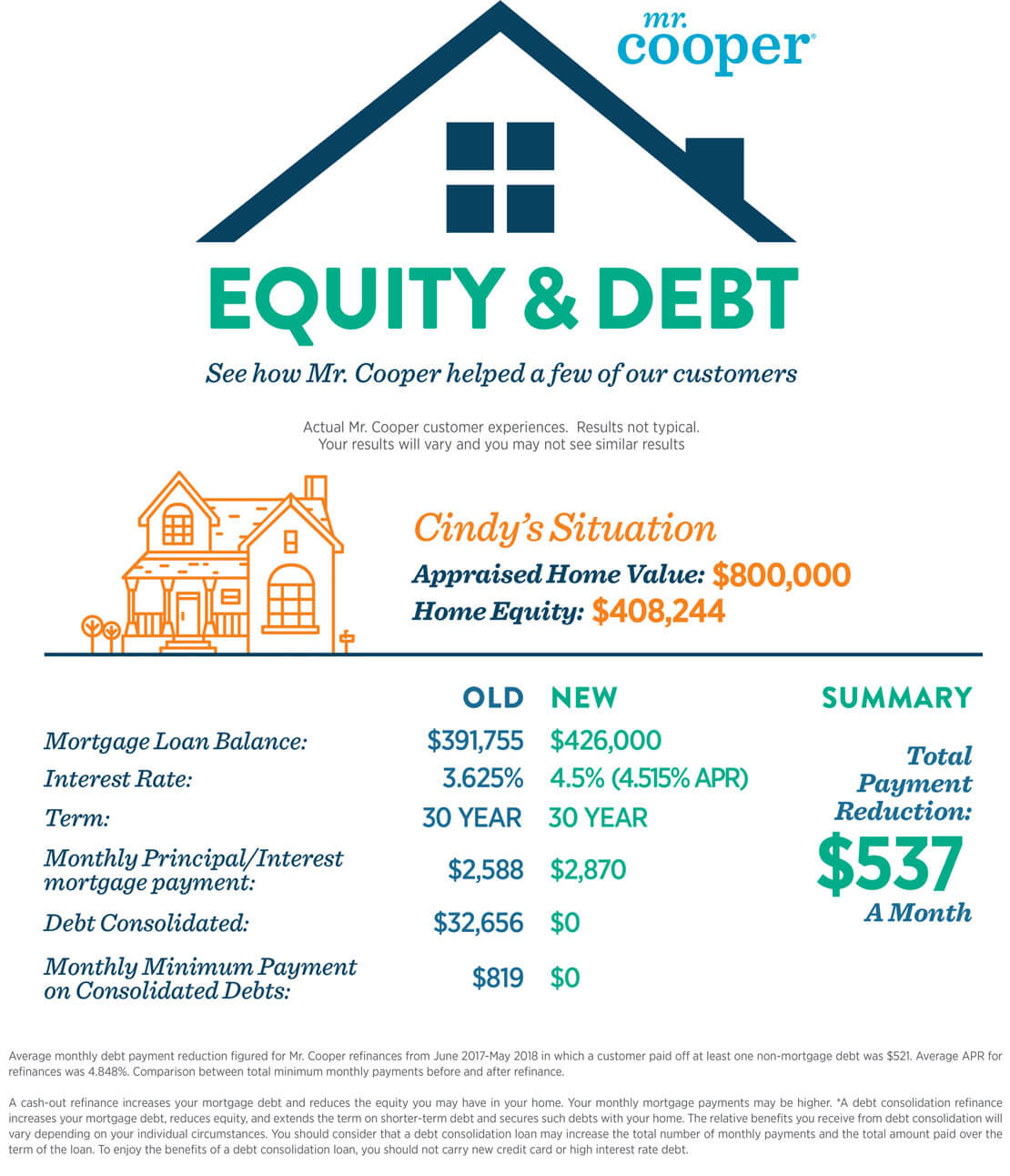

5%. Most loan providers need that your existing DTI be less than 50% to re-finance your loan. Equity In Your House You'll require to already have a substantial amount of equity integrated in your home if you wish to protect a cash-out refinance. Keep in mind that your lending institution won't let you squander 100% of the equity you have unless you get approved for a VA re-finance, so take a careful take a look at your present equity prior to you dedicate to a cash-out refinance.

2. Figure Out How Much Cash You Required Once you know that you satisfy the requirements for a cash-out re-finance, determine just how much cash you need. If you're preparing to cash out for repair work or restorations, it's a good concept to get a few quotes from specialists in your area so you understand how much you require.

8 Simple Techniques For moreira team (moreirateam01) - Profile - Pinterest

3. Apply Through Your Lender After you use for a cash-out refinance, you get a decision on whether your lending institution authorizes the re-finance. This Site lending institution may ask you for monetary documents like bank declarations, W-2s or pay stubs to prove your DTI ratio. After you get an approval, your lending institution will stroll you through the next steps towards closing.

When it concerns getting the ideal FHA re-finance, it all boils down to your knowledge of the industry and how much you're able to shop around. Given that most homeowners have no idea how the market works, navigating, and finding what's going to work best is hard. That's where a professional home mortgage service like Moreira Team Home loan, Right guarantees to speed things up and assist their customers find the finest deal.

UNDER MAINTENANCE